Full news release on the partnership available here

Strategic Partnership Deal Terms

Osisko pays Regulus US$12.5 million (C$16.6 million) and receives certain rights described below:

There are existing royalties covering various claims at the AntaKori project currently held by private parties. If Regulus acquires any existing royalties on the AntaKori project from a third party, Osisko can acquire 50% of the royalty by paying 75% of Regulus’ purchase price.

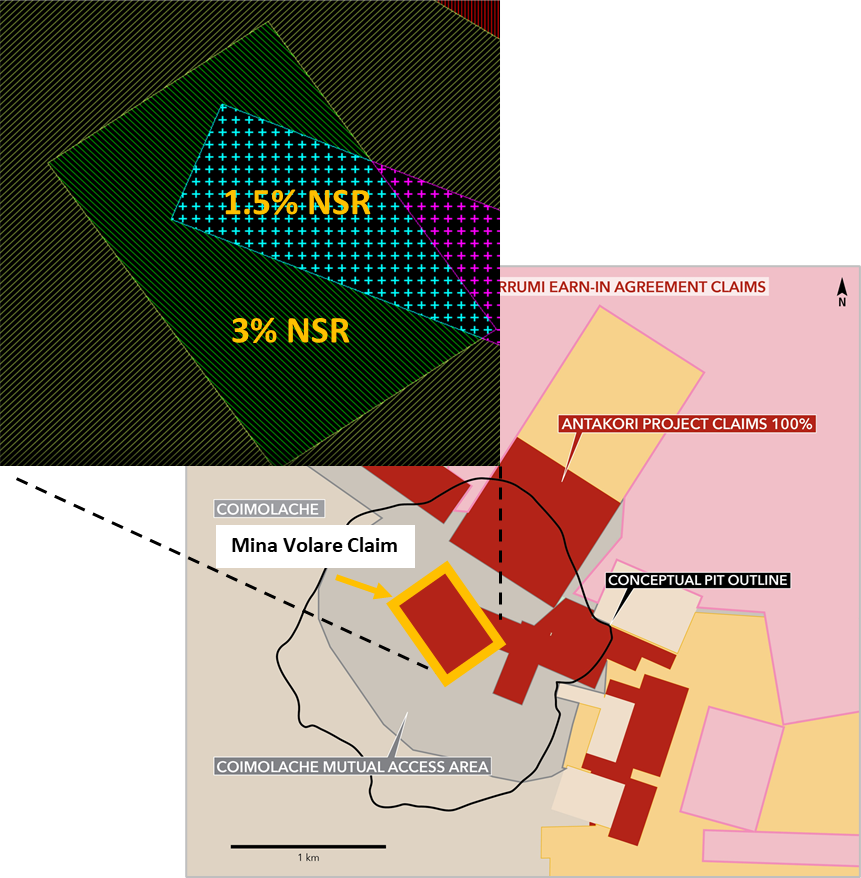

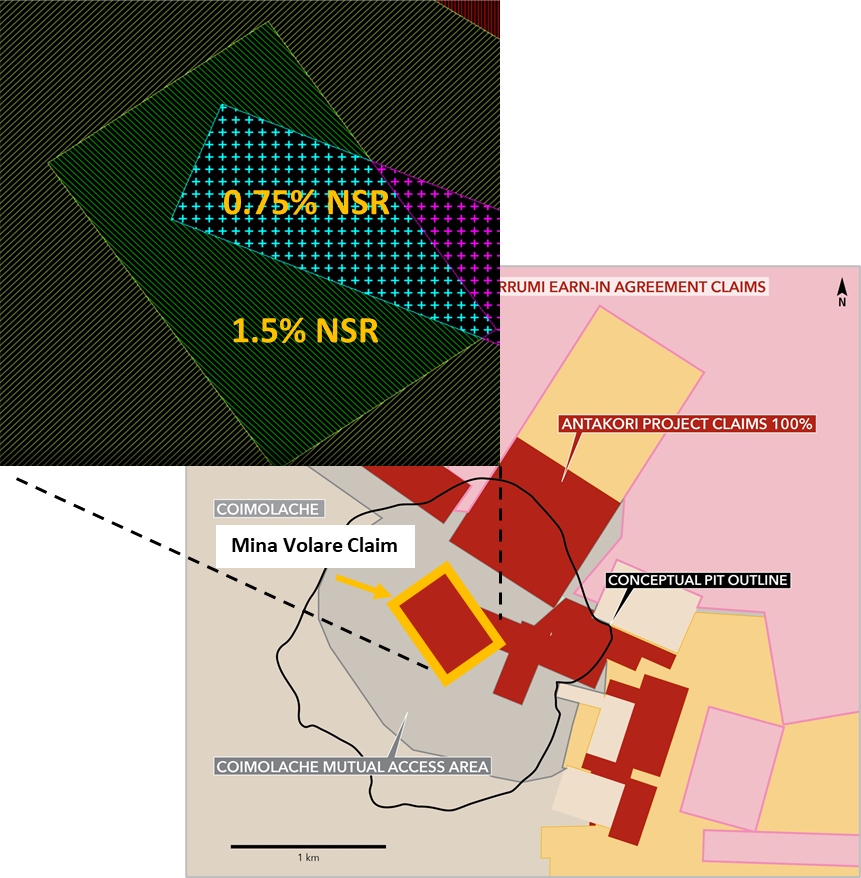

‒ Regulus has acquired a 1.5% or 3% NSR (depending on location) on the Mina Volare claim of the AntaKori project for US$750,000 from a private vendor. As an initial transaction under the partnership, Osisko acquired half of the royalty and Regulus elected to retire the remaining half.

Right of first refusal on future streaming and royalty sales.

Should Regulus receive a royalty or stream as consideration for the sale of AntaKori, Osisko will have a right of first refusal if the Company later sells that royalty or stream.

Regulus issues 5.5 million warrants to Osisko.

Benefits to Regulus Shareholders

IMMEDIATE INJECTION OF CAPITAL

- US$12.5 million (C$16.6 million) paid to Regulus

- Company fully financed for Phase II drill program

REDUCTION IN OUTSTANDING ROYALTIES

- Reduced royalty on Mina Volare claim of AntaKori project by 50%

- Osisko will pay 75% of the cost towards future royalty acquisitions which would reduce royalties on additional claims of the AntaKori project by 50%

TECHNICAL ENDORSEMENT

- Osisko known for their ability to identify and invest in high quality projects

- Osisko shares our vision for the future development of the AntaKori project

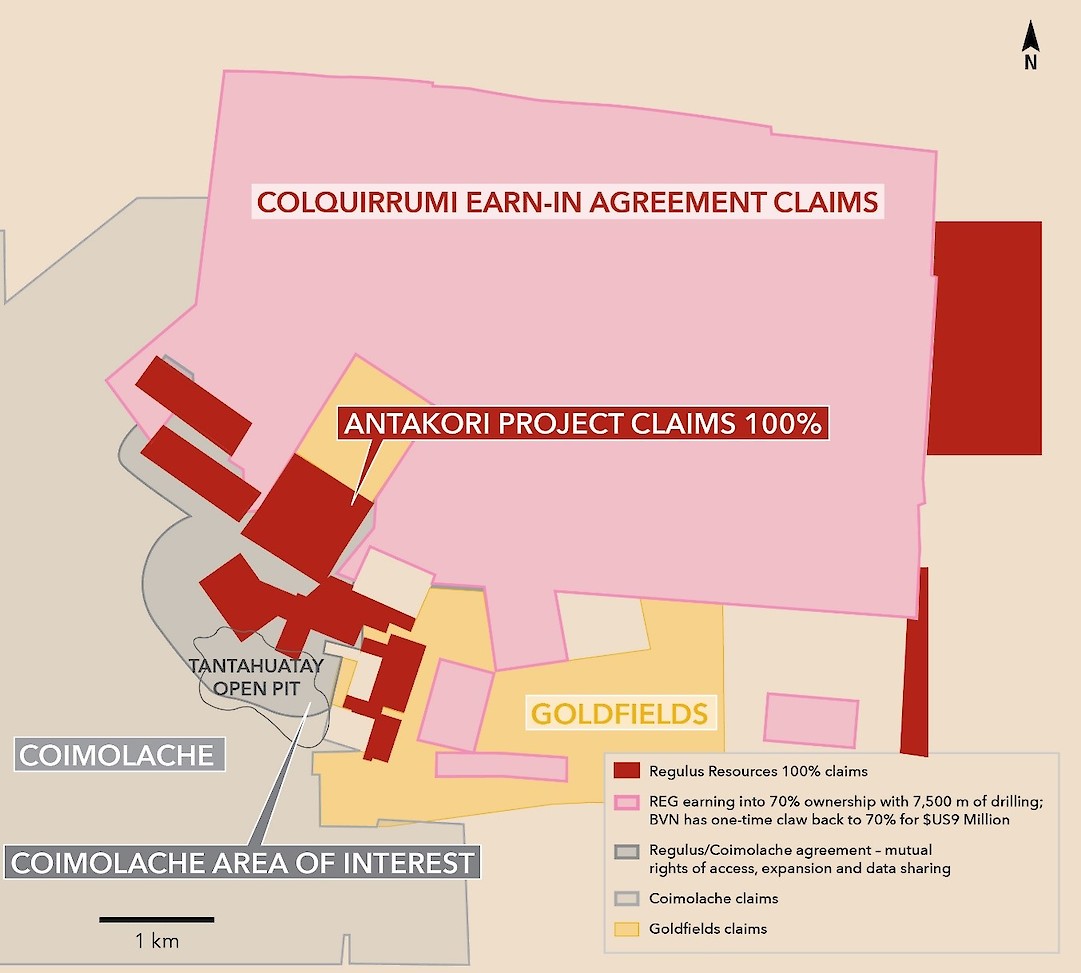

Figure 1. Claims Map

Figure 2. The Previous Royalties on the Minera Volare Claim

Figure 3. The Current Royalties on the Minera Volare Claim

________________________________________________

Regulus Announces Additional US$5.0 M Investment From Osisko Gold Royalties

Full news release on the investment available here

October 14, 2022 (Vancouver, BC) - Regulus Resources Inc. is pleased to announce the completion of a US$5 million investment (the “Investment”) from Osisko Gold Royalties (“Osisko”) in exchange for a net smelter return (“NSR”) ranging from 0.125% to 1.5% on certain claims of the Company’s AntaKori project (“AntaKori”), as well as a right (currently held by Regulus) to buy-back a 1% NSR from a third party on certain claims of AntaKori. Proceeds from the Investment will be used for exploration activities at AntaKori and for general corporate purposes. This Investment is the second completed by Osisko on the AntaKori project. The first was the strategic partnership between Regulus and Osisko announced on October 1, 2020 (the “Strategic Partnership”).

Highlights

- The Investment represents a significant financing in challenging capital markets.

- No incremental royalties on the claims where Osisko acquired a 0.75-1.5% NSR through the Strategic Partnership in 2020, where the majority of current NI 43-101 resources lie.

- Deal structured such that the NSR’s issued in relation to the Investment together with existing outstanding royalties will not exceed 1.5%.

- Brings cash into the treasury with no dilution to shareholders.

- The Investment allows Regulus to continue to advance exploration activities on the AntaKori project and maintain its social commitments.

- Represents a strong technical endorsement for the AntaKori project.

Details of the Transaction

Regulus, through its wholly owned Peruvian subsidiary, will grant to Osisko an NSR on certain claims of AntaKori ranging from 0.125% to 1.5%. As well, Regulus will transfer a right to buyback a 1% NSR for US$4.5 M on the Maria Eugenia, Maria Eugenia No1 and Rita Margot claims. As per the Strategic Partnership, Osisko previously held the right to acquire 50% of the 1% NSR on Maria Eugenia, Maria Eugenia No2 and Rita Margot if Regulus had exercised its buy-back right. In accordance with the Investment Agreement entered into by Osisko and Regulus, consideration of US$5 million was paid to Regulus on closing. See Table 1 and Figure 1 for details of where the new royalties will be applicable and the overall royalty profile of the project.

Figure 1 – AntaKori Project Claims Map

| Table 1 - Royalties Outstanding on AntaKori Property Following the Investment | ||||

| Claim Name | Third Party NSR | Current Osisko Royalty | New Osisko Royalty | Total Royalty Outstanding |

|---|---|---|---|---|

| El Clavel | 1.50% | 1.50% | ||

| Mina Verdecita | 1.50% | 1.50% | ||

| Maria Eugenia No 1* | 1.375% | 0.125% | 1.50% | |

| Maria Eugenia* | 1.375% | 0.125% | 1.50% | |

| Maria Eugenia No 2 | 1.50% | 1.50% | ||

| Napoleon | 1.50% | 1.50% | ||

| Rita Margot* | 1.375% | 0.125% | 1.50% | |

| Demasia Inquisicion | 1.50% | 1.50% | ||

| La Inquisicion | 1.50% | 1.50% | ||

| La Incognita | 1.50% | 1.50% | ||

| El Sinchao | 1.50% | 1.50% | ||

| Sinchao No 1 | 2.0% | 2.00% | ||

| Sinchao No 2 | 2.0% | 2.00% | ||

| Sinchao No 3 | 2.0% | 2.00% | ||

| Tres Mosqueteros | 0.00% | |||

| Valle Sincaho 2 | 1.50% | 1.50% | ||

| Valle Sincaho 3 | 1.50% | 1.50% | ||

| Valle Sinchao 4 | 1.50% | 1.50% | ||

| Mina Volare | 0.750 - 1.50% | 0.750 - 1.50% | ||

| * A buyback right exists to purchase 1% of the Third Party NSR in exchange for US$4.5 M. This will be transferred to Osisko. | ||||